The Long View: Fiscal Year 2015 Bus and Rail Ridership Summary

As Fiscal Year 2015 drew to a close last month, we figured it’s time to take the long view: how did ridership do this year?

On the whole, for an average weekday over the last year:

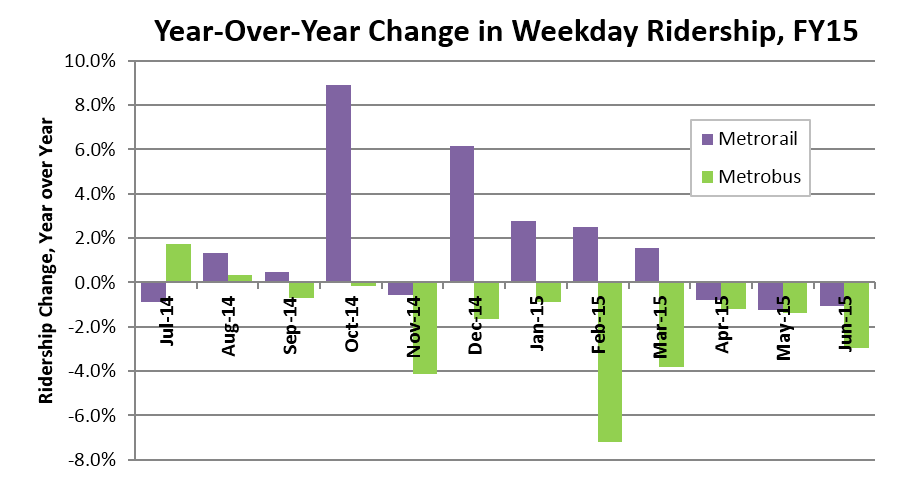

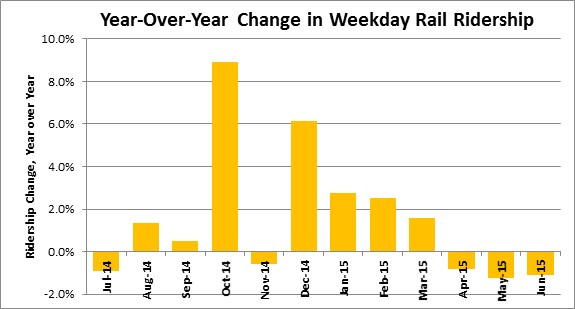

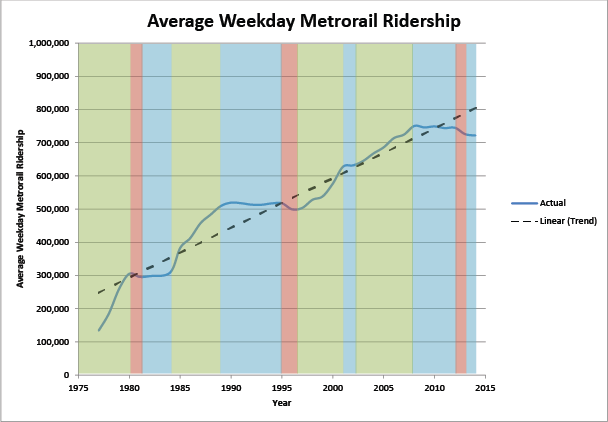

- Rail ridership was up by 1.5%, in part due to the introduction of the Silver Line.

- Bus ridership was down by 1.4.

- Rail ridership was up largely due to the federal government shutdown in October of FY14.

- Metrorail had a good fall and winter, while Metrobus started the fiscal year well but struggled in the winter and spring months.

Seasonal Trends. All changes in ridership are best shown as a comparison to the same time last year, because ridership rises and falls as the seasons change. Traditionally, ridership is lowest in the winter, and peaks twice: one in late March/early April for the Cherry Blossoms, and then again in June and July when tourists and outdoor activities are in full swing. August is usually slow, and then ridership levels stabilize again in the fall. Read more…

Recent Comments