Is the DC Streetcar Hurting Ridership on Metrobus X2+X9? No.

The DC Streetcar has not significantly changed ridership on Metrobus X2 and X9, even though the services overlap on H Street NE. Instead, the Streetcar appears to be serving a new, different market – and has increased net transit ridership in the corridor by 15%.

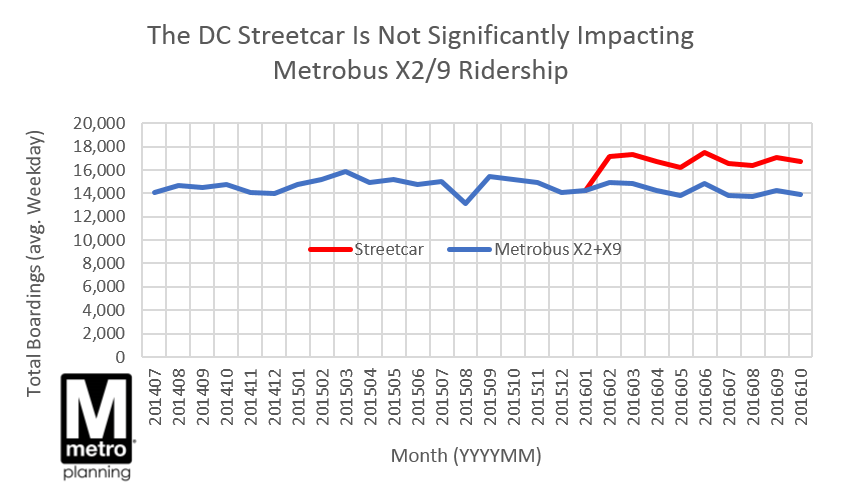

Although the new first phase of the DC Streetcar serves some of the same sections of H Street NE as the existing Metrobus routes X2 and X9, the streetcar appears to be serving almost an entirely new market of transit riders. Ridership on the underlying Metrobus routes X2 and X9 have remained fairly steady, even as the Streetcar is serving over 2,500 new riders per weekday.

Since it opened in February 2016, the DC Streetcar’s ridership has been climbing slowly and steadily, from around 2,400 to 2,800 boardings per weekday. The route, just over 2 miles long, runs from near Union Station down the length of H Street NE. The X2 and X9 buses run on the same stretch of H Street NE, but stop at different bus stops and connect farther west into downtown D.C., and farther east to Minnesota Avenue. The overlap in markets is fairly small, and the ridership data confirm that the two modes are serving distinct markets – ridership on the X2 and X9 has remained flat, or only slightly down. Overall transit boardings between the two modes combined have risen 15%, from around 14,700/day before the Streetcar to 16,800/day now. (Note the lift in X2+X9 ridership in June, likely due to SafeTrack Surge 2).

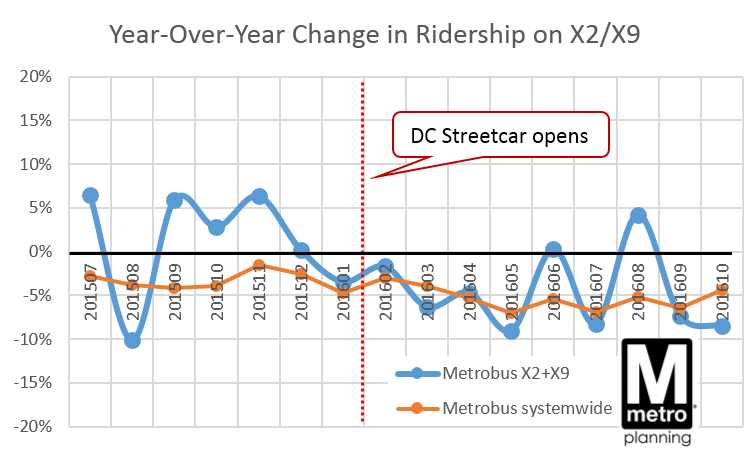

The Streetcar’s arrival does coincide with perhaps a minor shift in the rate of change in ridership on the X2+X9: monthly year-over-year change in ridership turned slightly negative last winter. But this is not dramatically different from the systemwide change in Metrobus ridership. So it’s not yet clear if this trend is due to riders switching to the Streetcar, or other forces.

Although the two modes overlap for a short stretch of H Street NE, the arrival of the DC Streetcar appears to be serving a new, distinct transit market. The Streetcar has not significantly poached riders from the existing X2 and X9 Metrobus routes, which have much higher overall ridership and serve a larger geographic area.

Recent Comments