Prioritizing Metro’s Capital Investment Needs

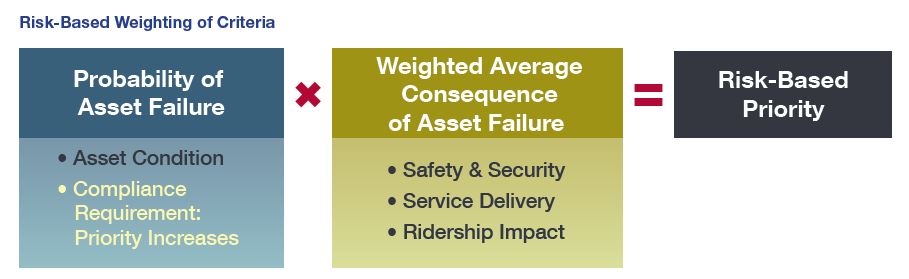

Metro used a risk-based multi-factor methodology to score and rank its 10 year capital needs.

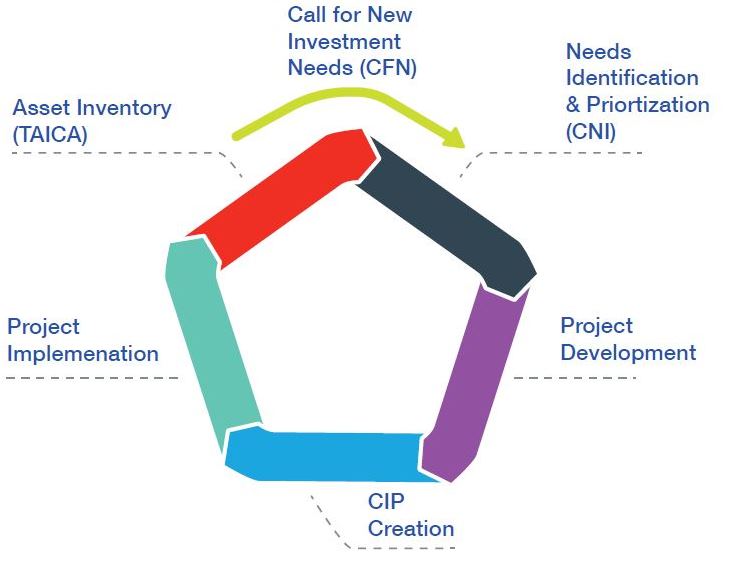

Metro’s 2016 Capital Needs Inventory (CNI) aims to capture and quantify Metro’s existing and anticipated capital needs over the next ten years. With our needs far outpacing available funding, prioritization of capital needs is critical. But with the ever present constraints of budget, time, and staffing, how do we determine how to prioritize our new and existing needs across a 10 year period? Metro used a risk based approach to develop its 10 year capital needs prioritization. Each criterion is defined based on the impact of an investment to improve an asset’s condition, to thereby improve Metro’s state of good repair or to mitigate asset related risks.

The risk-based prioritization approach is illustrated above. This approach considers both the likelihood of asset failure and consequence of asset failure. The scoring uses weighted criteria, to represent either the likelihood or consequence of asset failure. For instance, the scoring helps us to decide if it is more urgent to replace one kind of asset over another in any given year, given agency priorities and finite resources. A safety focused weighting scenario, based on the extent that an asset’s failure would affect overall system and rider safety was developed to reflect Metro’s core mission and values. It was also important that Metro’s weighting criteria be aligned with its larger strategic goals. The image below demonstrates how Metro’s strategic goals were aligned with CNI scoring weights.

Once Metro’s 10 year capital needs were identified and compiled, they went through several rounds of prioritization testing based on the risk-based approach and generated prioritization scores for individual assets in the asset inventory.

After the completion of CNI, the identified capital needs must be further verified and then converted into build-able projects through a design and engineering process, which will define actual capital projects with scopes, schedules, cost estimates, and delivery methods.

Recent Comments