How Metro’s Federal Customers Pay Fares, and Why It Matters (3 of 5)

Metro’s federal customers pay fares a little differently than other riders. Why is that such a big deal for Metro’s financial future?

(Third in a series of posts on Metro’s Federal customers – see posts 1 and 2)

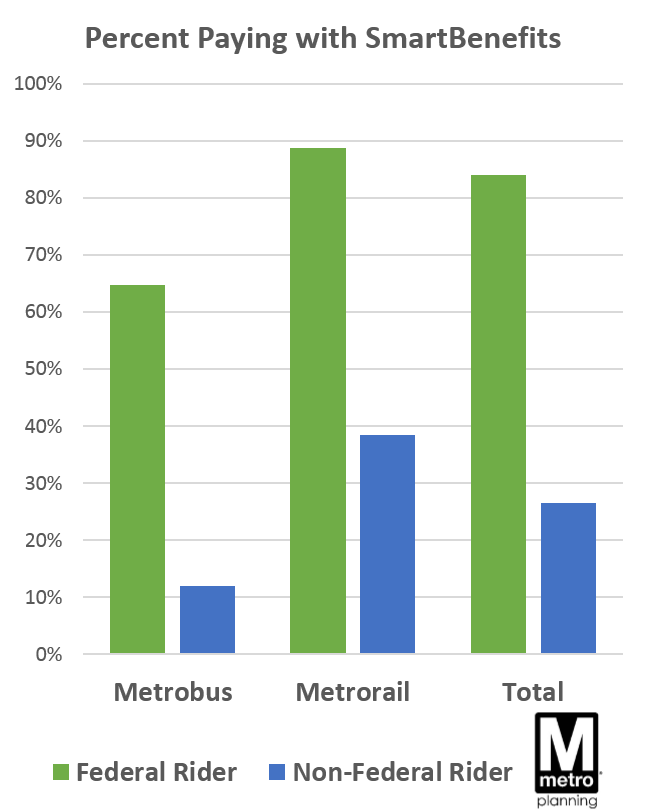

Compared to other riders, Metro’s federal customers are much more likely to pay their fare using SmartBenefits. SmartBenefits are the type of funds you load onto your SmarTrip card – usually through your employer, either as direct subsidy, or a certain amount of pre-tax dollars you set aside for transit fares. Metro riders in the Washington region may know the program manager WageWorks.

Compared to other riders, Metro’s federal customers are much more likely to pay their fare using SmartBenefits. SmartBenefits are the type of funds you load onto your SmarTrip card – usually through your employer, either as direct subsidy, or a certain amount of pre-tax dollars you set aside for transit fares. Metro riders in the Washington region may know the program manager WageWorks.

(Importantly, SmartBenefits is not exclusively a federal government benefit! On the contrary, non-federal workers are nearly half the overall enrollment in the SmartBenefits program, and 42% of Metro’s overall ridership comes from riders paying with SmartBenefits. We’ll make clear the difference between SmartBenefits and SmartTrip in an upcoming Metro 101 post – stay tuned.)

84% of federal employees on Metro pay their fare with SmartBenefits, compared to 27% of non-federal customers. In addition, federal customers tend to pay higher fares on rail – because federal workers typically take longer trips and ride more at peak times (average peak fare $3.00, vs. $2.87 non-federal customers).

Finally, 87% of Metro’s federal customers pay using “stored value” (pay-as-you-go funds), rather than a weekly or a monthly pass. Very few still use paper tickets or passes – but this is similar to other riders.

Recent Comments