Squaring Circles: De-Mystifying Metro’s Budget and Funding Sources (Part One of Three)

One of the most critical issues facing public transportation is how to pay for it. In a short series of blog posts, we’ll try to explain Metro’s finances and give you tools to engage in budget discussions.

No matter where you stand on the question of supporting or using public transportation, one of the loudest and most constant debates is how to pay for it. It’s a complicated question that combines values, politics, resources, and legal obligations. It also revolves around the technicalities of multiple funding sources (fares, grants, taxes) and how those sources can be spent (allowable types of projects, legal requirements, matching funds, etc.). Most people probably know Metro operates under a yearly budget. However, that annual budget and Metro’s ability to raise and spend funds is shaped by a larger policy and planning framework. This initial post focuses on three pillars of that policy framework: the WMATA Compact, the Capital Funding Agreement (CFA), and the six-year Capital Improvement Program (CIP). It also summarizes the annual budget planning process.

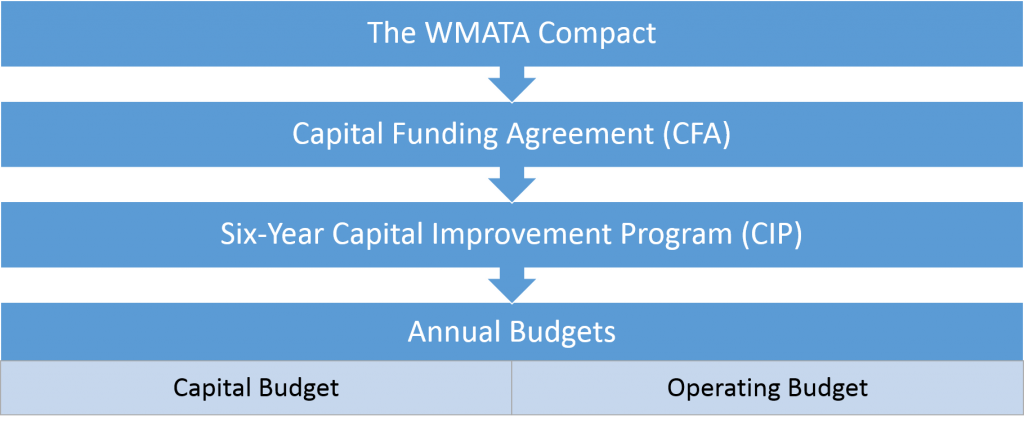

WMATA and the Metro System were created by a tri-state Compact between the District of Columbia, the State of Maryland, and the Commonwealth of Virginia, then ratified by Congress. The Compact created the Authority and outlined its general powers and obligations. It requires WMATA to formulate a regional mass transit plan, and to adopt a financial strategy for the construction and operation of projects and services identified in that plan. It also mandates the adoption of an annual capital and operating budget. An upcoming post will investigate the annual budget in more detail, but it’s important to know the difference between capital and operating funds. Put simply, capital projects are items Metro builds and maintains, or equipment it buys. This includes assets such as new buses and rail cars to replace old vehicles, improvements to bus stops, and parts to maintain vehicles, stations, and escalators. The operating budget pays to run the system on a daily basis: labor, fuel, electricity, employee benefits, fare payment processing, etc. As you’ll see in the next post, there are good reasons for separating funding this way.

The Compact’s legal requirement to adopt a financial plan is met at three different levels: the Capital Funding Agreement (CFA), the six-year Capital Improvement Program (CIP), and the annual budget.

The CFA is an arrangement between WMATA’s jurisdictional partners to fund the Metro system’s capital needs. The CFA prioritizes the types of capital projects the jurisdictions want to fund; estimates the types and levels of funding likely to be available; and establishes a funding mechanism that allows WMATA to undertake projects and make sure they’re paid for on a timely basis. The CFA is less about what is funded than how and who pays. The Compact and CFA require WMATA to apply for federal grants and program funds to support capital projects, and commit the partner jurisdictions to provide local matching funds for federal grants. Because WMATA does not have its own dedicated funding source, any project costs not covered by federal money or other fees must be covered by the jurisdictions. Those costs are billed to each jurisdiction according to the same allocation formula that applies to Metro’s operating subsidy, which will be described in more detail in a separate post.

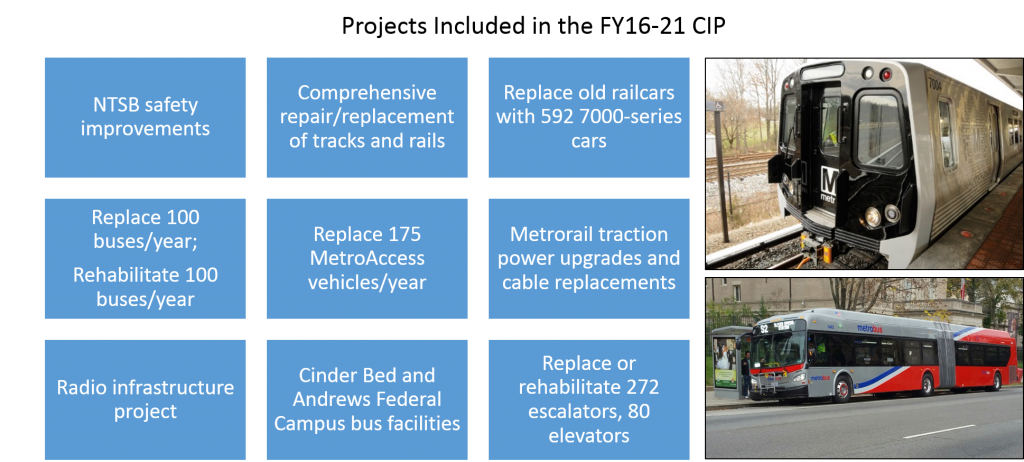

The detailed scheduling of projects and payments is determined by the six-year Capital Improvement Program and the annual budget. All of WMATA’s financial plans operate on the basis of a fiscal year that runs between July 1st and June 30th. The current CIP runs from July 1, 2016 through June 30, 2021, and includes a total of $6.2 billion in capital projects. This six-year investment plan tries to balance financial resources against necessary system improvements identified by NTSB safety recommendations, more routine asset management and repair work, and a few elements identified in the Momentum strategic plan. With our focus on safety and system rehabilitation, around 88% of the $6.2 billion is focused on safety and state of good repair projects. The CIP also includes $750 million for 220 additional 7000-series rail cars. These new cars were originally intended to support full deployment of 8-car trains during rush hour, but will now be used to replace the 5000-series fleet in an ongoing effort to improve the Metrorail system’s reliability.

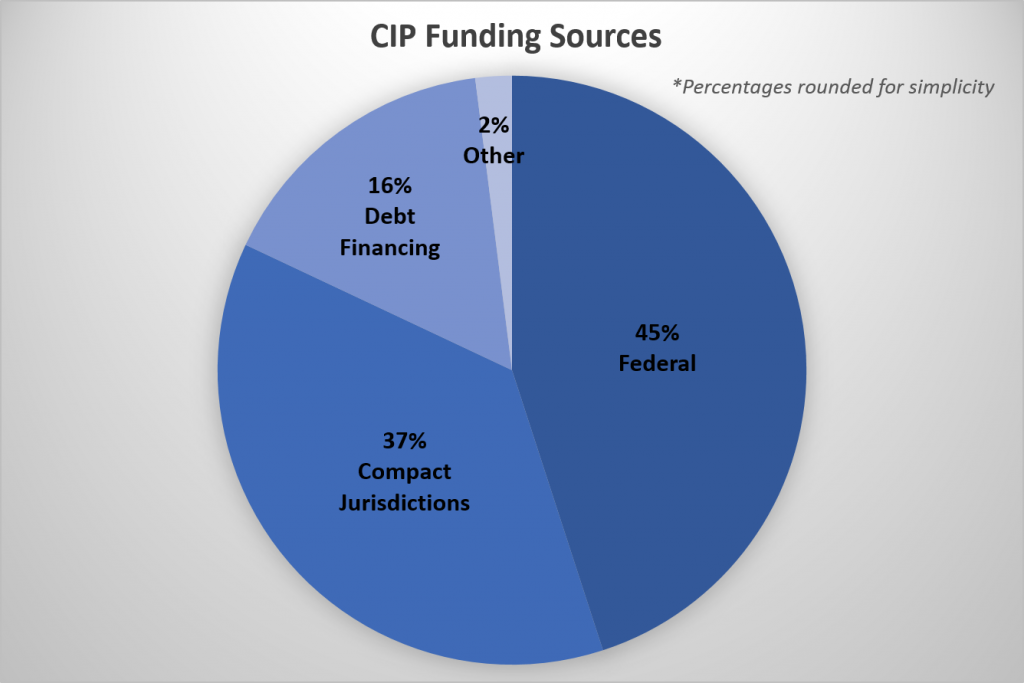

$6.2 billion is a lot of money, even spread over six years. Where does it all come from? 45% of it is programmed to come from federal grants and program funds, with the other 55% coming from local sources. That 55% non-federal share consists of $2.25 billion from state and local partners, $984 million in debt financing, and $108 million from other sources, including real estate leases, joint development proceeds, advertising fees, and other miscellaneous funds.

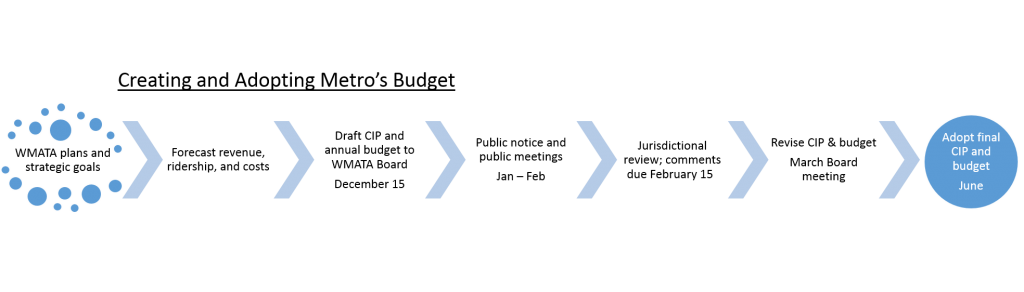

So who decides which projects are included in the CIP and how they get funded? The major inputs used to craft the CIP are the Momentum strategic plan, which identifies the long term actions and needs of the Authority, and Metro’s Capital Needs Inventory (pdf), which is a consolidated list of all the safety, repair, and asset replacement work we know the current system will need over a ten-year period. Each department within Metro aligns its business plan with those agency-wide priorities, and sends that plan and a list of needs to Metro’s budget staff and executive leadership. Metro’s budget staff works with other departments and our jurisdictional partners to forecast six-year growth or loss of population, jobs, ridership, fares, and county/city transit budgets. The management and budget team then draft a detailed budget for the next fiscal year and update the CIP for the following five years, and publish both for public review in December. Public meetings are held in January and February, during which presentations are also made to the executives and legislative bodies of the Compact jurisdictions. Staff consolidate and communicate feedback from the public and jurisdictions between March and May. The final budget and CIP must be adopted by June of every year, ready for the next fiscal year that begins each July.

CIPs used to be negotiated once every six years, meaning the system and its partners were locked into a six-year funding commitment. This process changed when the Compact partners negotiated the current CFA. Now Metro’s Board and partner jurisdictions adopt a detailed one-year spending plan with committed funds (the annual budget) plus a set of general spending guidelines for the five years after that, based on reasonable expectations of the system’s needs and available funds (the CIP). This change provided greater flexibility to react to critical needs and changing economic realities (such as variations in federal funding or local economic activity and tax revenue), but at the cost of certainty and reliability for larger, multi-year projects.

CIPs used to be negotiated once every six years, meaning the system and its partners were locked into a six-year funding commitment. This process changed when the Compact partners negotiated the current CFA. Now Metro’s Board and partner jurisdictions adopt a detailed one-year spending plan with committed funds (the annual budget) plus a set of general spending guidelines for the five years after that, based on reasonable expectations of the system’s needs and available funds (the CIP). This change provided greater flexibility to react to critical needs and changing economic realities (such as variations in federal funding or local economic activity and tax revenue), but at the cost of certainty and reliability for larger, multi-year projects.

What do you think about this policy and funding framework? Could it be simplified? Is there a way to provide more certain funding for larger projects, while also balancing the needs of all the different Compact jurisdictions? Do you think the budget process provides adequate opportunity for community review and feedback? If not, what could Metro and its partners do to make the process more accessible and more interesting? Would that type of engagement be better suited to Metro’s Board, or the county and city governments that help pay for the system?

Recent Comments