Going Up – Why the Construction Pipeline Means Higher Metrorail Ridership (Part Two)

In Part Two of this series, we forecast the impact of the region’s near-term development pipeline on Metrorail ridership, using the Land Use-Ridership model. The good news? Metrorail ridership is set to show big gains. The bad news? Your ride just got less roomy.

Just as we were putting the finishing touches on this post, we saw a flurry of news articles detailing the regional market forces that portend increased rail ridership. Millennials choosing not to drive, even as they grow up. Office parks in far-flung places experiencing devaluations while Metrorail-adjacent areas capturing the lion’s share of new leases. Marriott announcing that it will seek a transit-accessible location when it moves. And even defense contractors coming to bat to argue for the economic benefits of the Purple Line. All of this free publicity set us up nicely for what we wanted to share with you – the first results of the Office of Planning’s Land Use-Ridership model as applied to near-term development projects.

The Near-Term Pipeline. Researchers at Jones Lang LaSalle have been compiling a list of actual development projects – under construction, or planned – near Metrorail stations, so that we can forecast the near-term capital needs for the system. A huge amount of development (over 105 million square feet!) is on the books for within a half-mile of a Metrorail station.

So, How Much Ridership? What impact will all of this have on Metrorail? We ran these projects through the Land Use-Ridership model, and what we found was both intuitive – and startling.

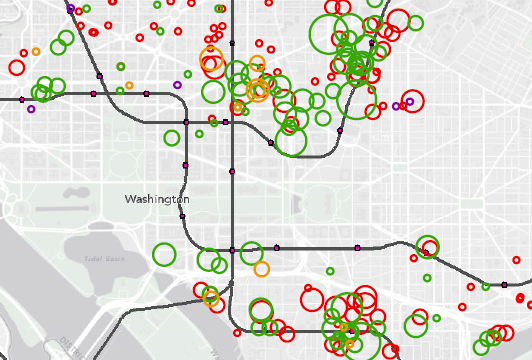

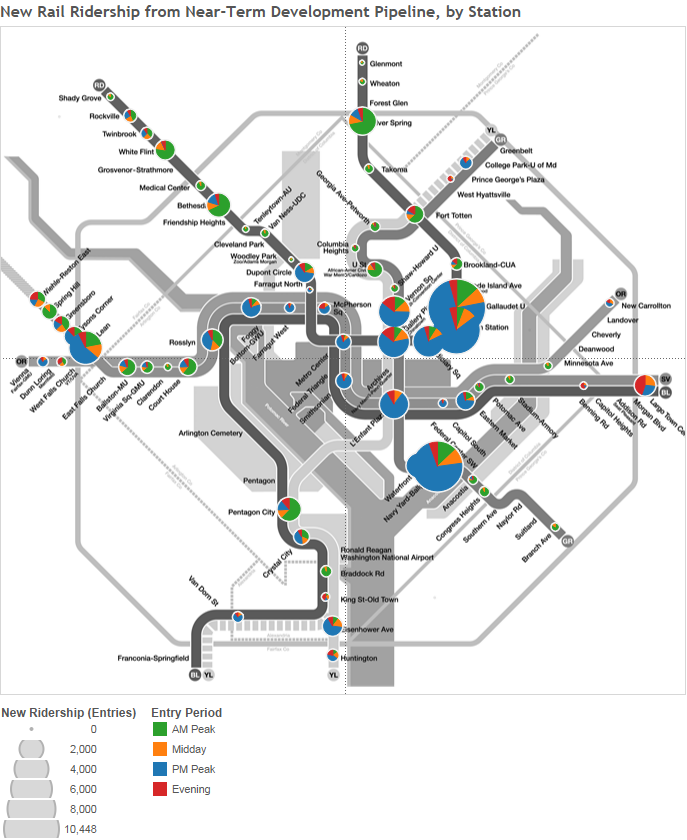

The model output suggests an additional 84,000 trips per average weekday, or additional revenue of about $240,000 per day. In other words, assuming that everything else remains the same, development projects already on the books should yield over a 10% increase in Metrorail ridership. Of this new rail ridership, 35% of it is coming from projects that are under construction today (about 30,000 trips) and the remainder of the projects are slated for completion by around 2020. The map below shows where these impacts will occur:

A quick reminder of how this all ties together:

- We’ve learned that accessibility is a key driver of ridership, in conjunction with the land use at a station area. That is, we can’t just concentrate development around Metrorail, the development must be connected to useful “stuff” through the rail network.

- If we develop one station A, other stations upstream and downstream gain accessibility as well.

- We’d see ridership at other stations, not just at station A, because the development has made Metrorail a better value proposition generally.

There are lots of ways that one can slice and dice the underlying data (we have included the aggregate project summaries by station but due to data licensing considerations cannot reveal individual buildings) and we’d love to know what patterns or trends you see.

And in the meantime, we’re going to keep working hard to make sure that Metro 2025 is fully funded so that all of these trips can move quickly through the rail network and its core stations.

How far in the future do these trends project? I guess the question is really when is the last building in JLL’s list expected to deliver?

@David Koch

The development data from JLL goes through just about 2020. A small portion of the projects in the pipeline don’t have an exact delivery date, which probably means they’re in more preliminary stages than the near-term projects.

The model assumes 84,000 new trips. Are they net or gross? If someone moves from the suburbs to the District and already uses Metrorail it is not a new trip. If the person who buys the suburban home rides Metrorail then it would become a net additional trip for Metro. Also, some of these new, close-in workers and residents may decide to take the bus.

@ Steve (Strauss)

A few notes on the model, which is outlined in detail in the previous post on this topic (https://planitmetro.com/2015/04/06/going-up-why-the-construction-pipeline-means-higher-metrorail-ridership-part-one/) and I recommend as background reading!

First, it is built using demonstrated Metrorail ridership vis-a-vis existing land use patterns (households, jobs, train frequencies, etc.) In that sense there are bus trips that are currently generated by the land use patterns as well but we are neither ignoring them nor undercounting them in the future. In that sense, the model undercounts net Metro ridership (rail AND bus) overall because it is not producing an estimate for Metrobus ridership at this point.

Second, the model is currently configured with a really conservative assumption – that future changes in jobs and household counts are related. Meaning that when we add a job to a station and a household somewhere else, that the new household is affiliated with the new job. The model could in theory increase its forecast output if we assumed that the new job located at the Metorail station is moving a trip from the roads to Metrorail, and in a separate activity the new household located at the Metrorail station also moves a trip that otherwise was on the roads (or would be) to Metrorail.

Certainly some of those moves could take place, but we want to remain on the conservative side of this as well as reduce the number of “what if” scenarios that such an estimate would require.

I really don’t understand why the anticipated increase at Dunn Loring and Vienna aren’t greater, with all of the development in those areas…

I really don’t understand why the anticipated increases at Dunn Loring and Vienna aren’t greater, with all of the development in those areas…