Metrorail Ridership Projections – Looking Ahead

Historical data and regional growth projections tell us one thing – Metrorail ridership will rebound and grow right along with the region, and the system better be ready to carry the load.

Local ridership trends that seem to defy a national boom in public transit usage give some pause about the need for planned transit expansion projects. It’s no surprise that even the most ardent of transit supporters might be caught flat-footed when trying to defend infrastructure investments against the backdrop of scarce funding. Some have even gone so far as to question whether Metorail ridership, which just a few years ago looked poised to eclipse 800 thousand trips per average weekday, is experiencing more of a structural downshifting and may experience flat or even declining ridership for the foreseeable future.

All of this debate is understandable in a town obsessed with statistics and “horse race” leaderboards. But when it comes to economics, demographics, mobility, and infrastructure, regional leaders need to look beyond the numbers d’jour and bet on a sure thing – Metro ridership will go up. Here’s why:

1. Short-term snapshots of rail ridership miss the forest for the trees. Or maybe even just leaves.

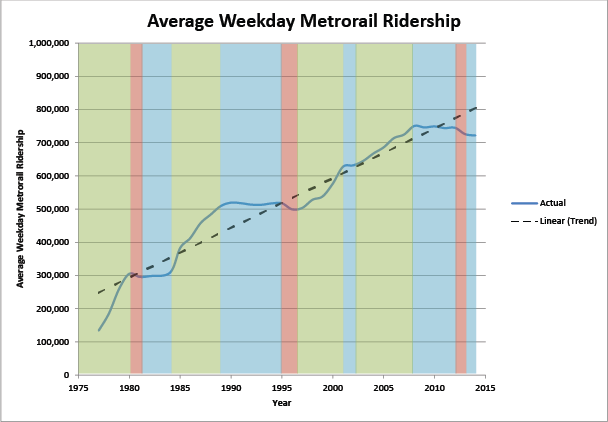

The graph below shows Metrorail average weekday ridership from the beginning of Metrorail. You can see that ridership grew in the first five years as the system grew from just the Red Line and four stops in 1976 to adding Orange and Blue Lines in operation by 1980. And after all of that expansion was completed, something fascinating took place – ridership declined and essentially flatlined until 1985. During that time, the region didn’t stop investing in Metro. On the contrary, during that same time period Metro built the Yellow Line and extended the Red Line from Downtown into Upper NW DC and then all the way to Shady Grove. Ridership shot up again in the late 1980s while Metro extended the Orange Line to Vienna and the Red Line to Wheaton then flat-lined and even declined through the mid 1990s, all while Metrorail added capacity on Yellow and Blue and (finally) opened up the Green Line. From 1997 through the late 2000s Metrorail saw robust ridership increases despite minimal capacity increases – largely reflective of the underlying economic and demographic resurgence of the central city and its urbane suburbs – and ridership flat-lined in tandem largely with the economic collapse of 2008 and the prolonged Great Recession.

That broad arc and very simple history of Metrorail ridership tells us that through oil shocks, stagflation, the S & L Crisis, the Iraq War(s), 1990s recession(s), the dot-com boom, the dot-com bust, the housing boom, the housing bust, the Great Recession, and sequestration, Metrorail ridership has always risen strongly and rebounded from any setbacks. Those that underestimate Metrorail ridership today would have to somehow isolate today’s economic conditions and forecasts as being so especially divergent from the challenges this system has faced to-date that historical precedent and Metro’s own track record are to be disregarded.

2. The current ridership trajectory will adjust as consumers react to “new normal” pricing. Recently, Metro’s Office of Planning dissected the ridership trends over the past few years and arrived at a startling conclusion – that the drop in transit benefit has had a direct impact on rail ridership, and that without such a devaluation in transit benefits, rail ridership might actually be up year-over-year. Customers have a variety of choices when it comes to commuting, and especially for Metro’s longest-distance customers who were receiving subsidized trips, the current cost of transit travel has become markedly more expensive as compared to the marginal cost of driving (especially with today’s gas prices). Some have brought these facts to Congress and a bill is now pending in the House that may restore tax benefit parity for transit commuters. While we at Metro would welcome tax fairness for our customers, we know that Congress may or may not change the transit benefit to pre-2014 levels. Meanwhile, the region is still adding households and jobs, and is projected to do so for decades to come (PDF). Those jobs are increasingly in the private sector, meaning fewer employees tied to federal transit benefits are part of the growth wave. And some of these new workers will take transit. In the medium-term, then, which for sake of argument we can consider the next 18-20 months, ridership will likely bounce back and continue to grow alongside regional economic growth. Should relative pricing change again there may be other short-term adjustments, but they don’t rob Metrorail of the underlying trajectory of rising demand, rising ridership.

3. The region has bet BIG on transit-oriented development, and is doubling down on that investment. In the fall of 2013, Jones Lang LaSalle, CoStar, and Delta Associates released findings that stated “[o]f the 5.5 million square feet of office space under construction in the region, about 4.6 million of it, or 84 percent isn’t just near a Metro station but within a quarter mile of one”. In June of 2014 Jones Lang LaSalle updated those figures for WMATA and found that “over 105 million square feet of new development are either under construction or proposed within .5 miles of an active Metro station.” That means a TON of new ridership is on the way – soon. Research into ridership patterns in the D.C. Metro area by the University of Maryland’s National Center for Smart Growth confirms the Office of Planning’s analysis that transit-adjacent properties directly generate ridership, either from households, or from jobs that are near station exits.

The fact of the matter is that economics is rarely linear and major capital investments aren’t based on decisions that turn on a dime or a whim. While the growth trajectory for the region continues to be strong – and we at Metro have yet to come across a jurisdiction that is projecting an economic contraction or planning for massive employment or population losses – the underlying spatial and economic data tells us that the region will continue to depend on Metro to get around. And that’s why its still important to make sure that important capacity-building projects such as those contained in Momentum’s Metro 2025 – Eight Car Trains, Core Station Improvements, and the Metrobus Priority Corridor Network – are absolutely critical to get funded now so that this region can continue to grow and prosper strongly and sustainably.

I mean, yes, a number of these factors matter. But what also matter – and are absent from this and almost any discussion of ridership – are service levels, which continue to deteriorate (yes, even at peak hours), and which no one at WMATA seems to have shown any interest in increasing.

Run more trains and people will ride them. When service is frequent enough to rely on after 6:30 PM, people will in fact rely on it. But that’s not the case today.

WMATA, yes, there are more transit options now, but for many of my trips, Metro is the most direct route. And I don’t take it, particularly on weekends, because the trains don’t run often enough and because good transit information about the possible delays isn’t available. If you’re running 20 minute headways and I have to transfer, it could take up to an hour to go a couple of miles. I want to use you, and you’re making it unfeasible.

Metro seriously needs to consider moving to driverless trains and having the whole thing be run from an operations center. Cities around the world are starting to do this. The number of trains that can be run at all hours would skyrocket and make using Metro in times other than rush hour feasible again. Ridership is down because service levels are really getting rotten outside of rush hour(s). Once you make people think about other options you could lose them for a long time.

Need to track peak hour ridership rather than average weekday. Peak hour ridership determines how crowded the system is much more accurately than average weekday.

Also, this post does not consider the impact of teleworking and alternate work schedules on Metrorail ridership.

development concetrated around should increase ridership, but ridership growth would be greater if certain recent policy and operational obstacles were addressed. The post should do more to aknowledge this point and address the issues working against ridership growth.

Is the mix of trips changing? More specifically, is there a greater drop in short-distance trips than in long-distance ones or vice-versa? It could be that more people are choosing to walk or bike short distances, which would mean this slowdown is a short reprieve for WMATA to get their house in order and expand before numbers start climbing again.

Great conversation, everyone, and I appreciate the feedback.

Few items to consider:

@LowHeadways – we agree that train frequency is a factor that influence ridership. One of many, mind you, but a very important one. There is an upcoming post that describes our very recent statistical analysis of factors that drive ridership at a station-area level and that post will give our insights there. The related issue, of course, is whether we have enough fleet to run more trains and if we do so, whether the ridership impact will more than offset the operating cost impact of additional train frequency. We’re keen on nailing down an answer on that as well and I am personally working on that.

@Steve – Good to hear from you! I would direct you to earlier posts detailing the ridership trends within any given month that pretty much cement the case for the impact that the transit benefit reduction is having on ridership. The counterargument to that post would be that somehow telework and alternative work schedules all impact ridership only at the end of the month – meaning that everyone goes to work M-F during the first two weeks of the month but then starts working from home during the last two weeks of the month. Not impossible, but implausible.

To everyone who read this – we are also teeing up a post (and analysis) that details the impact of TOD already under construction on near-term ridership. In this post the JLL link indicates that there are 20M SF of projects within half a mile of Metrorail CURRENTLY UNDER CONSTRUCTION. We’re going to provide a sense of what that means to ridership when those projects finish over the next few years. Stay tuned!

@washcycle – great question and one that we do track and analyze regularly. region-wide we are seeing an increase in walk/bike trips as a % component of all commute trips, which is good for congestion and the environment. in a previous post I mentioned that walk/bike trips to Metrorail grew quickly over the 2007-2012 period while park/ride trips dropped off (as a % of total metrorail sources of entries).

the previous posts detailed that our long-distance riders that previously were using federal transit benefits were the ones that really dropped off in the past year, and absent that trend (influenced by tax policy at the Federal level) background ridership is actually UP 2%. That includes ridership in our urban core areas, where we continue to see that ridership remains strong and shows strong gains in areas where we have added station-area transit-oriented development.

so the answer to your question is “yes, and yes”. the mix of regional trips is changing, but where we add more modal options (bike/walk/carshare/bikeshare) in our urban areas we continue to see strong ridership and in fact some level of ridership growth.