What Value Does Metrorail Bring to Land Markets?

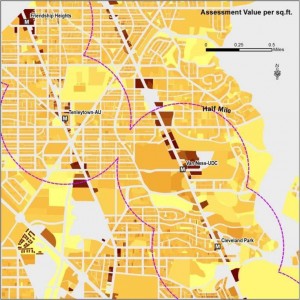

To measure Metro's impact on land markets, we analyzed property value assessment records across the region. Shown above is a sample from the District of Columbia.

A Metrorail station can make the land surrounding the station much easier to get to and from. Especially if traffic is bad and parking is costly, as often happens in our region, a Metrorail station can offer a good alternative means of getting to and from an area, which gives the area near rail an advantage over areas farther from rail. Businesses can locate near a Metrorail station and reach workers around the region, more people can live in the neighborhood and get around by transit, and customers can shop or run errands there. Economic theory tells us that the value of land around rail stations should reflect the value transit brings, as often does the density of development. Economists would say that the accessibility value of transit is capitalized into the land value.

But what is this effect around Metrorail stations, and how much is it worth? How much land value is associated with Metrorail, and how much property tax revenue does this generate for Metro’s jurisdictions?

To answer, we analyzed parcel-level property assessment values across the WMATA Compact jurisdiction as part of our “Business Case” for transit study. We analyzed all properties, including residential, commercial, and federal office buildings. The data show that:

- Metro enables value-creating activity: $235 billion of property value sits within a half-mile of Metrorail station

- About 80% of this value is from commercial properties (multi-family residential, office, retail, and other)

- 28% of the Compact Area‘s property tax base sits on 4% of its land within a half-mile of Metrorail

- The land within a half-mile of Metrorail stations generate $3.1 billion in property taxes per year for our funding partners

New York Avenue station has helped enable valuable development. Photo courtesy of NCPPP, click for context.

This does not mean that Metro caused all of this development, but it does show that Metro serves the value-creating parts of our region. Some of this development existed before Metrorail, and influenced the decision of where to build stations. So, we ran a number of hedonic analyses (a statistical regression technique) to isolate the effect on property values uniquely from Metrorail proximity alone, or the “rail premium.” After all, property values can be influenced by a variety of factors, including proximity to other infrastructure, desirability of the neighborhood, etc. Controlling for all other factors, we found that within the Compact area:

- Metrorail boosts property values, adding 6.8% more value to residential, 9.4% to multi-family, and 8.9% to commercial office properties within a half-mile of a Metrorail station – all other things being equal

- Property becomes even more valuable as a property gets closer to Metro stations

Others have shown too that new Metrorail stations can attract and spur economic development, by tracing the history of development around stations, such as New York Avenue and the Rosslyn-Ballston corridor.

These findings show that Metro plays a significant role in our region’s land markets: not only is valuable development and economic activity clustered around Metrorail, but the benefits of Metrorail can be seen in actual property assessments. Our regions’ land markets recognize and have responded to the value that Metro brings. This helps make the case that Metro is vital to the region’s economy, and is a good investment of public funds.

Read the study’s Final Report (pdf).

Cross-posted at Region Forward.

Recent Comments